Please check Calendar on Home page and/or Facebook Group for time and date.

TERMS AND CONDITIONS FOR

USE OF THE SPYGLASS WEBINAR

Spyglass Webinar Code: 209-868-085 Join Spyglass

for April 7, 2020

SCROLL DOWN TO ACCESS RECORDINGS

AS A COURTESY - - - -PLEASE MUTE YOURSELF WHEN YOU HAVE NOISE IN THE BACKGROUND

OR YOU ARE CONDUCTING OTHER CONVERSATIONS. THANK YOU.

Spyglass Q&A Webinar Rules and Policies

By entering The Spyglass Webinar you hereby agree to the Terms contained herein.

Welcome to the Option The Money (OTM) live Spyglass Webinar.

Please note: The live Spyglass Webinar (Spyglass) is provided as an enhanced learning forum and meeting room and for coaching purposes. No personal trading or investment advice is provided. You are completely responsible for your own trades. Any type of trading, including but not limited to options trading and other derivatives, carries with it a high risk. You should only trade with capital you can afford to lose. Investing Risk: Trading securities can involve high risk and the loss of any funds invested. Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon, or risk tolerance. Options Trading Risk: Options trading is generally more complex than stock trading and may not be suitable for some investors. Be aware that trading in certain option strategies can result in the loss of more than the original amount invested. Before trading options a person should review the document Characteristics and Risks of Standardized Options, available from your broker or any exchange on which options are traded. NO SOLICITATION. NO RECORDING. NO REPRODUCTION. No part of the Spyglass may be copied, recorded, downloaded, or rebroadcast in any form without the prior written consent of OTM or Make It and Keep It, LLC (MIKI) or its officers. Any member who enters and participates in the Spyglass acknowledges and agrees to be respectful to other members and the instructor and not to cause disturbance. If any member becomes disruptive, disrespectful to other members and/or instructor, such member will be asked to stop and if member refuses to stop such activity such member will be asked to leave the Spyglass. Any disruptive member may be banned from attending the Spyglass if such activity and behavior continues and such member will have the membership banned and no refund will be issued. The information and data contained in the Website was obtained from sources believed to be reliable, but accuracy is not guaranteed. Neither the information, nor any opinion expressed, constitutes a recommendation to purchase or sell a security, or to provide investment advice. ANY MEMBER WHO ENTERS THE TRADING PIT ACKNOWLEDGES THAT THE SPYGLASS OR ANY PART OF THE SPYGLASS DISCUSSIONS MAY BE RECORDED BY OTM/MIKI; AND THEREFORE ANY MEMBER ENTERING THE SPYGLASS HEREBY GIVES HIS/HER CONSENT TO BE RECORDED AND SUCH RECORDING MAY BE USED BY OTM/MIKI IN ANY LEGAL MANNER OTM/MIKI DEEMS NECESSARY FOR PROMOTION, ILLUSTRATION, TESTIMONIAL OR ANY OTHER REASON WITHOUT ANY COMPENSATION DUE TO MEMBER WHO MAY HAVE BEEN RECORDED IN THE USED RECORDING.

Selling options is perhaps the best way to minimize risk and to maximize consistent returns, but selling requires some due diligence.

Covered Calls and Credit Spreads are not so fragile or risky as to require too much work, but you must have some ground rules to establish your wealth building plan.

Fundamental Checklist to follow:

- Create a Watch List of stocks that could potentially be owned and used for this strategy. You may need to allow a stock to be sold and to enter a different and better premium paying position;

- Create a spreadsheet to easily enter prices and premiums to determine the best possible upcoming trades;

- I recommend that you do not use more than 60% of your available cash to buy into stocks;

- Make sure that you know each stock and what makes it move – know the news on that stock;

- Determine if it is best to buy the stock directly or to use Short Puts to possibly get into the position;

- Once you own the stock you must decide if you want to have your Short Call position exercised thus obligating you to sell your shares. You must know if the stock value is likely to continue rising or will it be dropping soon. Just because the stock price is likely to pull back is not an immediate decision to sell the shares you hold. You can continue placing Covered Call positions and collecting premiums. If you don't care whether you are obligated to sell, then you must decide which Strike Price to sell - In-The-Money or Out-Of-The-Money;

- Once you understand the basics of the Covered Call Strategy and you are well on your way, you may want to look at incorporating Cash Covered (Naked) Short Puts at the same time to enhance your wealth building. You can utilize the cash and margin to accomplish this enhancing strategy;

- With the Short Puts you must also know whether you want to be obligated to buy more shares; and whether you have the money to purchase more, or are you simply looking to collect premiums and staying out of range - Out-Of-The-Money. Adding the Short Put Strategy can increase your returns between 30% to 100% for the year;

- Just remember not to trade on gut feeling or guessing. Make sure you are following the system and making an educated decision.

- Even though you may have buying power due to the margin provided by the broker, I highly discourage using that buying power except in very limited situations which we discuss in the Q&A sessions.

BEST WAY TO START:Ask yourself, "If I own this stock at the current price, can I enter a SHORT CALL which will pay me a decent premium?" If the answer is YES, then proceed by reading the chart and determining if you want to enter a SHORT PUT or buy the stock outright and enter a COVERED CALL.

**************

SPREADS require that you start with the Chart and find the SUPPORT or RESISTANCE, then you look for the appropriate SHORT XP and determine if the Credit amount is acceptable.

**************

REMEMBER:You never go broke taking a profit. No need to be greedy, fearful, or anxious. Plan your trade and then trade your plan.

**************

The best way to make money in any environment is to follow the CARDINAL RULE OF MONEY and make your money work for you.

God Bless and remember…

Prosperity is the name of the game…

Get started…Create Your Own Economy and

MAKE IT AND KEEP IT!!!!

Trade of The Day

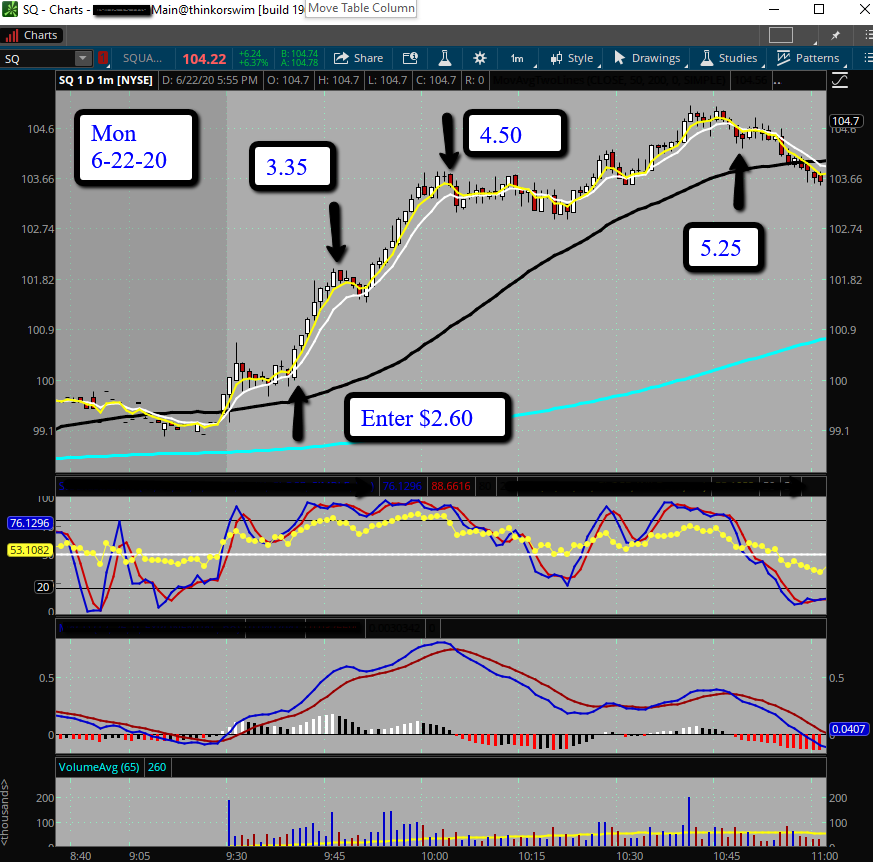

SQ scalp on a LONG CALL enter at $2.60 and can exit at 3.35 for a .75 profit or place a TRAILING STOP LOSS and get knocked out between 4.35-4.50. If you placed a good Trailing Stop Loss here then you would have gained up until 5.40. With or without the Stop Loss you would have or should have exited in the neighborhood of 5.25.

All in all, you enter at $2.60 and gain $2.65. On 10 contracts, you trade $2,600 and exit with $2,650.

My exit point is at the $4.50 price for a gain of $1.90 or $1,900 on 10 contracts. Rolling the dice for the extra gain violated the Stochastic and MACD.

If you followed the 5 minute chart then you would have stayed in until the $5.25 price.

REMEMBER:

Not everyone's trading plan is the same, so any stocks listed are for information purposes and not intended to be considered financial advice or recommendations. These are the stocks I or other members are considering - if you wish to consider the same stocks please conduct your own analysis and due diligence.

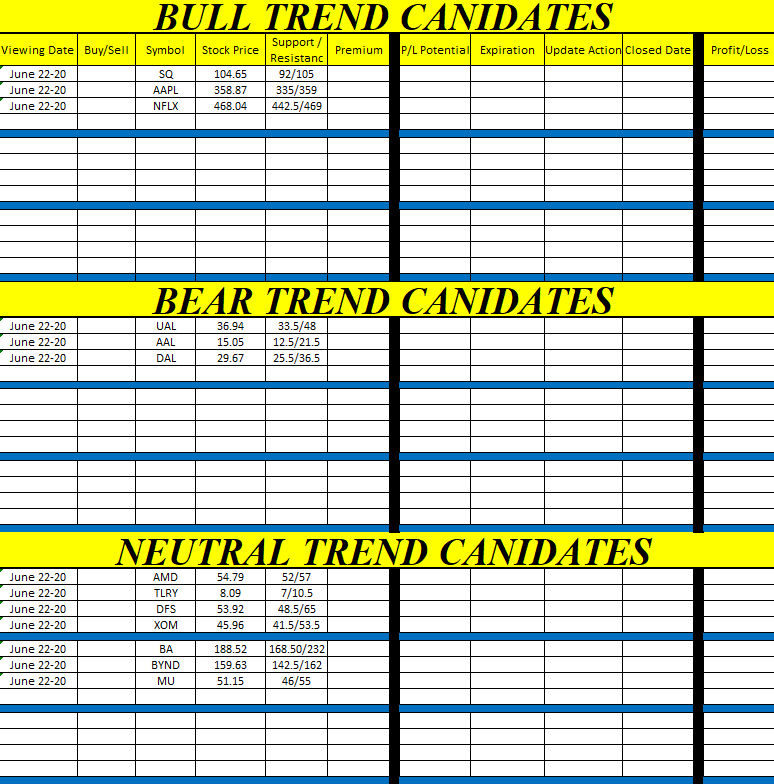

The BULL, BEAR and NEUTRAL listings are considered for TREND trades as well as Spreads. The NEUTRAL TREND list is also a candidate for potential CONDOR trades.

Keep in mind that the market, and indicators, can shift very quickly, so make sure you do an up to date study of each stock and its appropriate chart before entering or exiting a trade.

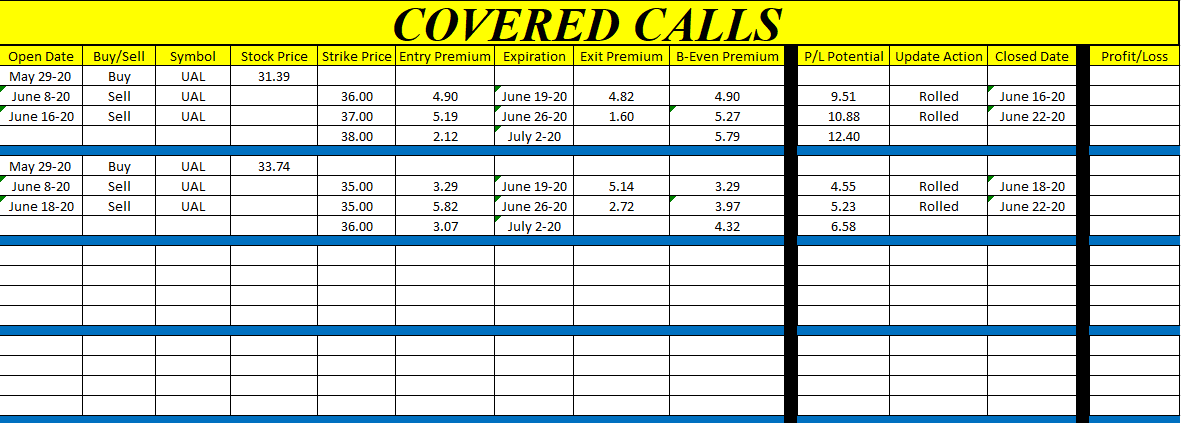

The COVERED CALL list is a list of stocks owned by MIKI and/or members and the likely appropriate COVERED CALL being considered or already entered.

If you have any trades you are considering and would like to share them please let me know and I will include them in these lists and provide whatever help I can - which does not replace your due diligence before entering or exiting any trade of any of the stocks listed here.

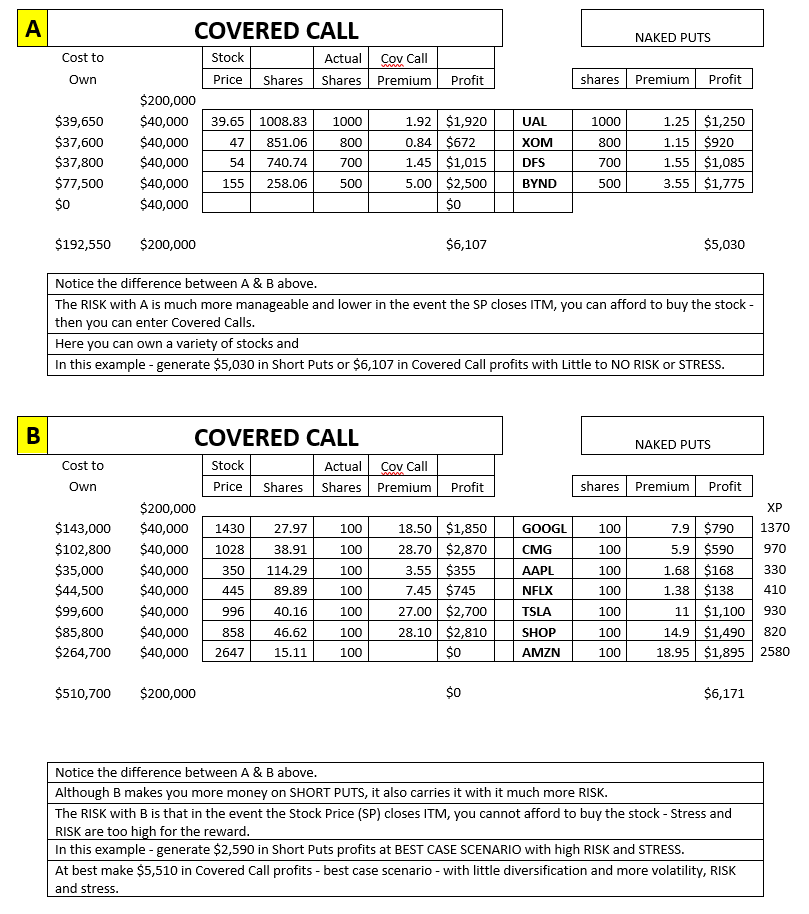

Allocation Breakdown - Example

This breakdown is an example of how I would approach an account in which I want to trade stocks and possibly end up owning shares at some point.

The parameters are lo risk, low stress, very good returns, naked PUT possibilities, Covered Call possibilities, acceptable share ownership.

June 24, 2020

Spyglass listings discussion. Allocation of Trades and watch lists. Market approach. Naked Calls and Covered Calls.

October 3, 2019

An approach and mandatory checklist to apply a Trend Trading System. Indicators are the same, but the application and requirement for the appropriate stock and option strike price are different. Average expected ROI is a minimum of 80% per trade.

April 7, 2020

Review of Chart reading and possible alterations. Review of the Basic Option Rights and Obligations. LEARN THE MAIN OPTION SLIDE.